The MENA dairy market is poised for steady growth, projected to reach 85 million tons by 2035 with a CAGR of 1.3%. Whole fresh milk dominates consumption, and leading countries like Turkey, Iran, and Egypt drive over 66% of total regional demand. Value growth is expected at a CAGR of 2.0%, with the market reaching $102.8 billion by 2035. Despite recent consumption dips, import activity and product diversification continue to support market stability.

The dairy market in the Middle East and North Africa (MENA) is on a growth trajectory, projected to reach 85 million tons by 2035. This expansion is underpinned by a steady compound annual growth rate (CAGR) of 1.3% from 2024 onwards. In monetary terms, the market is forecasted to grow at a 2.0% CAGR, hitting a value of $102.8 billion.

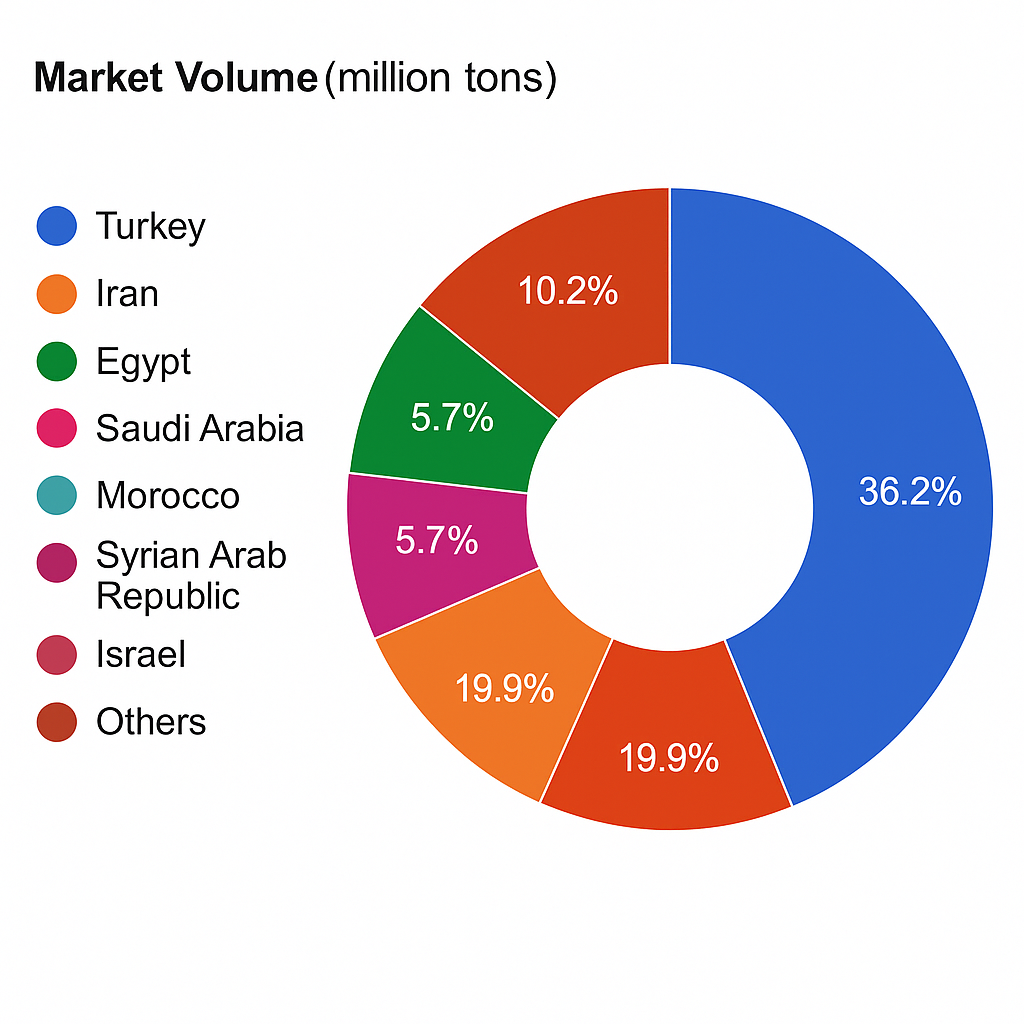

Regional Consumption Leaders

Turkey leads regional dairy consumption with 25 million tons, followed by Iran at 15 million tons and Egypt at 8.4 million tons. Collectively, these three countries account for 66% of total regional dairy demand. They are followed by Saudi Arabia, Algeria, Morocco, Syria, and Israel, which together represent an additional 24%.

This chart visually depicts the share of dairy volume by country in 2024, highlighting the dominance of Turkey, Iran, and Egypt.

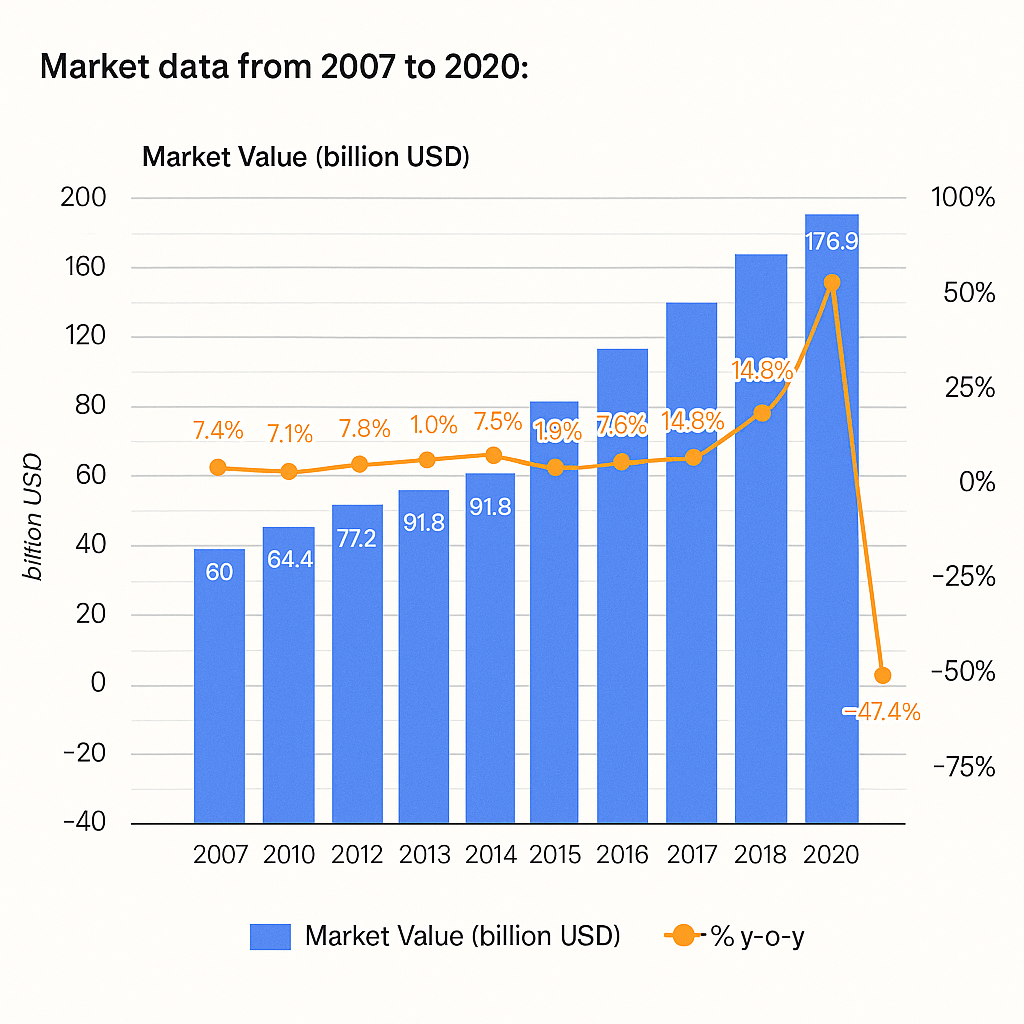

Market Value Trends Over Time

From 2007 to 2020, the market value saw a general upward trend, peaking in 2019 at $176.9 billion before falling sharply in 2020 to $93.1 billion—a 47.3% decline. Despite this drop, long-term indicators suggest a recovery aligned with broader consumption trends.

This line chart illustrates how dairy market value evolved over the years, including the sharp dip in 2020.

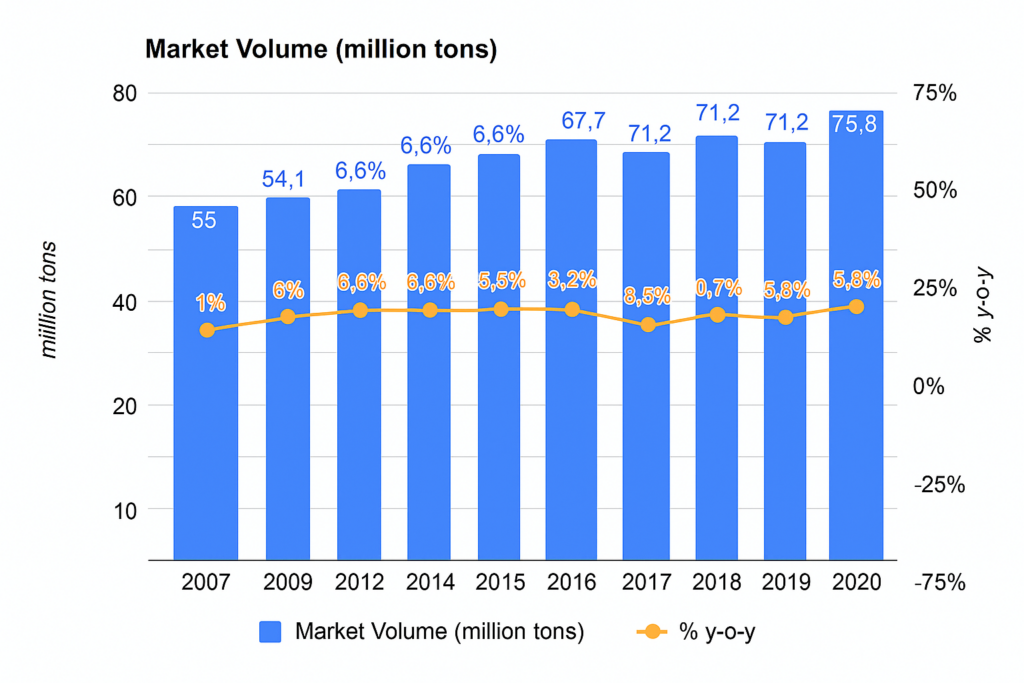

Volume Growth and Consumption Patterns

In volume terms, dairy consumption hit 75.8 million tons in 2020. Although consumption dipped slightly from its 2021 peak of 77 million tons, growth remains steady. Consumption in 2024 increased by less than 0.1%, reflecting a cautious rebound.

The volume growth chart shows fluctuations in overall dairy consumption, helping explain recent trends.

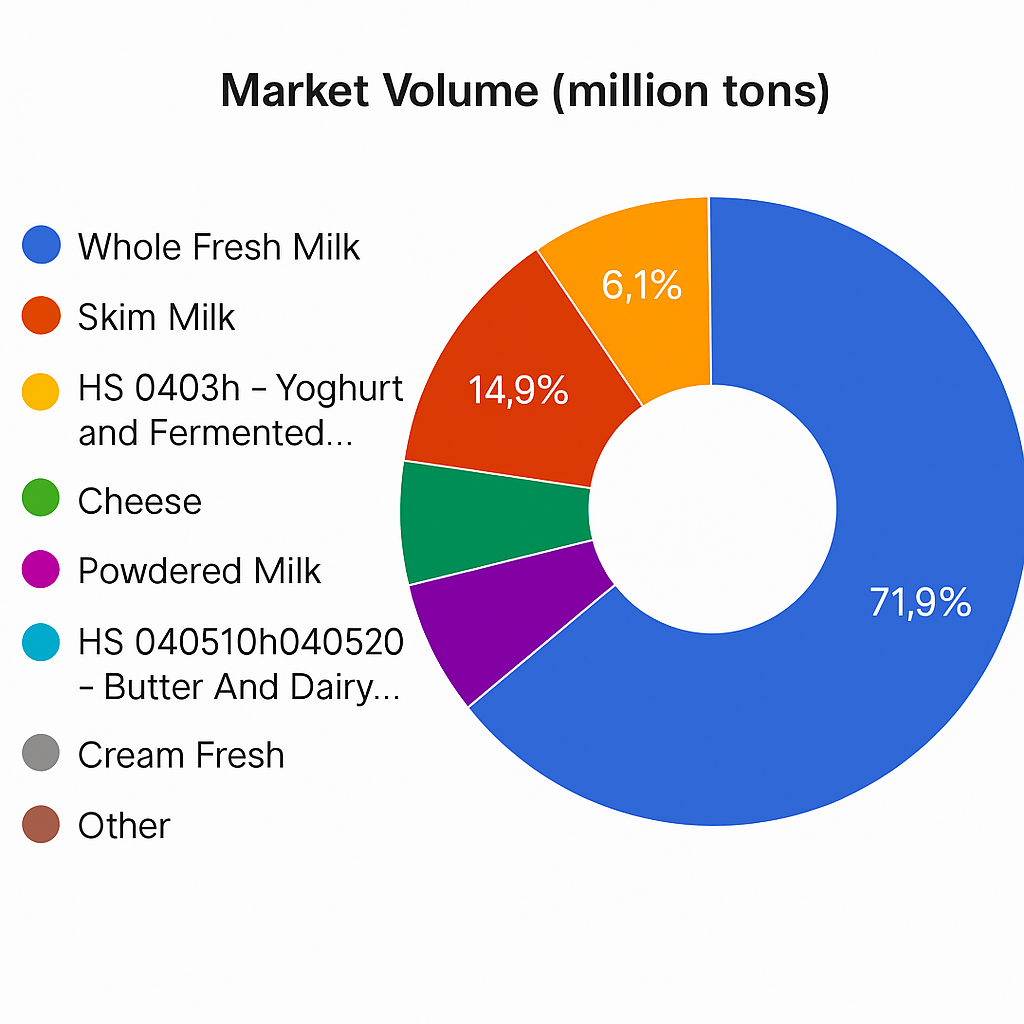

Breakdown by Product Type

Whole fresh milk remains the cornerstone of dairy consumption, accounting for 71.9% or 53 million tons of the total volume. Skim milk (14.9%) and yogurts/fermented products (6.1%) follow. In terms of market value, whole fresh milk also leads at $39.1 billion, followed by cheese ($16.5 billion).

This chart breaks down consumption by product category to show which dairy types are most in demand.

Imports and Strategic Outlook

Despite short-term setbacks, the MENA dairy market exhibits resilience, with imports rising 1.8% year-on-year in 2024. Saudi Arabia, the UAE, and Algeria are the key importers, reinforcing the market’s structural reliance on external supply chains.

As the region continues to invest in dairy infrastructure and innovation, the future of dairy in MENA looks promising—anchored by high-volume consumers, growing product variety, and strategic international trade.